Posted on March 08, 2022

For newer investors in silver, there are a lot of questions that commonly come up during the buying process. If you’re uncertain about whether or not you should buy silver, you’re not alone.

Investing in silver bullion can be rewarding, though there can be a lot to keep track of when considering your purchase. If you want to learn more about silver and exactly what other bullion buyers are wondering, this list is for you.

Silver is a refined, physical metal, available in various forms. Generally speaking, silver bullion refers to items made from silver whose price is directly tied to the quantity of silver they contain. In other words, silver bullion is priced based on the current spot price of silver.

Silver is a refined, physical metal, available in various forms. Generally speaking, silver bullion refers to items made from silver whose price is directly tied to the quantity of silver they contain. In other words, silver bullion is priced based on the current spot price of silver.

Silver bullion is a precious metal that has intrinsic value. As a prevalent and useful metal, it is essential to distinguish between items containing silver and actual silver bullion. For instance, a piece of jewelry can be made of pure silver but not classified as silver bullion.

Generally speaking, silver bullion includes silver bars, rounds, medals, and government coins (note that coins are priced and valued for their silver content, not their face values which tend to be absurdly low). Physical silver bullion is just one type of investment in silver. It’s important to distinguish that buying physical silver is completely different than other investments tied to silver (like certain ETFs, stocks, and commodities futures – in other words, “paper silver”).

The first and most obvious difference is that silver is significantly more affordable than gold per ounce. At the time of writing, $100 will get you a bit more than one gram of gold but will get you over three ounces of silver. Silver offers investors the same benefits of hedging against inflation with a physical commodity at a much lower price per ounce. This lower price-per-ounce also makes sense from a bartering perspective. In a bartering situation, you need to have “exact change,” and gold doesn’t lend itself to smaller, everyday transactions.

In addition, silver has many more industrial applications than gold, generating high demand from manufacturers of electronics, medical devices, dental products, and cars. This demand can mean higher upside potential compared with gold, which is primarily used as an investment or in jewelry.

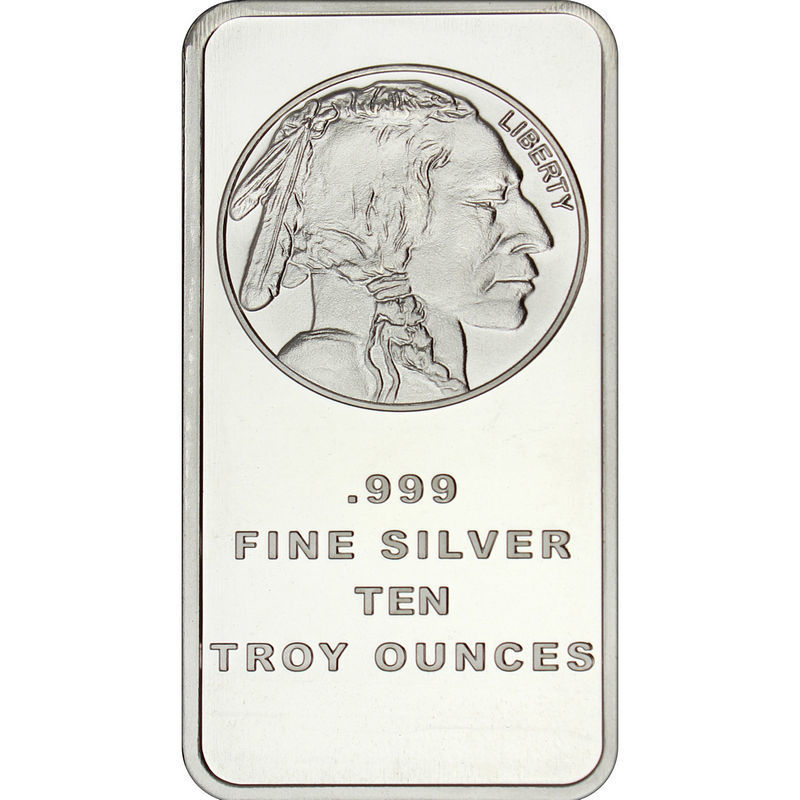

Silver bullion can come in various types but is often sold in the form of coins, bars, and rounds.

Silver coins are coins struck by government mints, which means they have a face value and can be spent like ordinary coin currency (though the face value is a small fraction of the value of the coin’s silver content).

Silver bars and rounds are high-purity bullion, varying only in shape and size from one another. Bars and rounds can be made by any private or government mint and offer the lowest premium over spot price and seldom have any sort of collectible value. Silver bars come in various shapes and sizes, ranging from the pocketable 1 oz bar all the way up to the rough, industrial 1,000 oz silver bars used to settle COMEX transactions.

Regardless of what the silver looks like, remember, the most important determinants of its value are its purity and weight.

Silver bullion costs are determined primarily by the spot price of silver (the current market price of silver) and the exact type of bullion product. Silver’s spot price constantly changes because silver is bought and sold worldwide 24 hours a day, 7 days a week. These fluctuations in price are based on supply and demand (just like stocks or other commodities).

Silver bullion costs are determined primarily by the spot price of silver (the current market price of silver) and the exact type of bullion product. Silver’s spot price constantly changes because silver is bought and sold worldwide 24 hours a day, 7 days a week. These fluctuations in price are based on supply and demand (just like stocks or other commodities).

The more elaborate and labor-intensive products sell for a higher “premium” over silver’s spot price. For example, a highly desirable coin like the 1 oz silver American eagle coin will cost more than a simple 1 oz silver bar. Due to its high quality, liquidity, and face value, government-minted coins are the most silver expensive bullion product.

Silver coins can also have collectible value, which is rarely (if ever!) the case with bars and rounds. While spot price is the driving force behind most silver bullion pricing, other costs like refining, packaging, and shipping contribute to small markups on silver bullion products.

Where you choose to buy silver bullion is a personal choice since you have the option of purchasing both online and in person. Before the internet, few options existed for buying bullion outside of local dealers and coin shows. Today, some people still prefer to buy silver from local bullion dealers, pawnshops, and coin shows.

However, for most buyers, purchasing bullion online is the fastest, easiest, and most affordable way to buy silver. There are many different online merchants where you can purchase bullion, from auction sites, peer-to-peer marketplaces like eBay, and our recommendation of choice–reputable dealers like BullionMax.

Click here to learn more about where to buy silver bullion.

Before you purchase silver bullion, you should account for the ongoing costs of owning and protecting your investment. Your ongoing silver bullion costs are storage and insurance, both of which will help you avoid unnecessary losses on your investment.

When silver bullion is shipped, it is usually packaged discreetly, with the pieces of bullion secured in vinyl sleeves. Individual coins and bars can be sent in rectangular plastic cases, while rolls of coins or rounds are packed in tubes. This plastic packaging protects from damage while the bullion is in transit and prevents it from moving around inside the box.

One popular choice for shipping silver bullion is the monster box. Monster boxes are used by several government mints and built to transport and store a set of 500 coins, neatly divided into even stacks or rolls. Most bullion is dispatched via registered USPS mail, which is the safest method of bullion shipping. Some online dealers – like BullionMax – even offer free shipping on orders over $199.

Storing silver bullion is something you should consider before actually having your bullion in hand. Your storage options include precious metals depositories, home storage, or safe deposit boxes. Precious metals depositories are the safest and most sensible option but can be expensive.

Storing silver bullion is something you should consider before actually having your bullion in hand. Your storage options include precious metals depositories, home storage, or safe deposit boxes. Precious metals depositories are the safest and most sensible option but can be expensive.

A safe deposit box is certainly a fine choice, though it may not be suitable if you have larger volumes of bullion. For those who take home security seriously, a home storage solution for your silver bullion is possible. However, you will be hard-pressed to rival the security of a precious metals depository or a bank.

Finally, a common problem unique to silver is the volume of space it occupies. If you buy $10,000 worth of silver at the current trading price, you would have roughly 30 pounds of silver to store, which might overflow your home safe or bank safe deposit box. If you’re looking to invest enormous sums in precious metals, consider adding some gold to your purchase (to save space if nothing else!)

Silver bullion insurance is an important purchase to protect against potential losses to your cache of silver. The safest and easiest way to insure your silver bullion is to store it in an authorized depository. There, it will be fully covered under the depository’s policy, so you never have to worry about making payments or adding newly acquired bullion to your policy.

If you choose to store your silver in a safe deposit box at a bank, the chances are that silver is not insured. For those storing silver at home, it is a good idea to purchase a bullion-specific policy through Brink’s or a specialty bank since your homeowner’s insurance will likely limit coverage on precious metals to a maximum of $2,500. (Check your policy documents to confirm.)

Unfortunately, there are still unscrupulous individuals who produce or sell counterfeit bullion. To avoid becoming the victim of fraud, your best bet is to do business exclusively with creditable, trusted bullion dealers.

The internet is a great place to find honest reviews about bullion dealers, so make sure to see what others are saying about a dealer on websites like the Better Business Bureau and ShopperApproved. Another tip for avoiding counterfeit bullion is to live by the old adage, “if it sounds too good to be true, it probably is.”

Silver bullion can be taxed both during the initial purchase and during a profitable sale. When purchasing silver bullion, sales tax is dependent on the particular state. Several states do not impose sales tax on silver bullion products, while others tax precious metals in the range of roughly 5-7 percent on average.

If you sell your physical silver bullion, you will have to pay taxes on the realized gain of that sale. Depending on whether you owned the bullion for a period of time that exceeds one year (long-term capital gains tax), you will pay the appropriate IRS collectibles tax, which tops out at 28 percent. In a situation where you buy and sell bullion for a profit within one year, you will be responsible for paying ordinary income tax on the earnings from your sale.

BullionMax takes the guesswork out of trying to account for all the intricacies in making the perfect silver bullion purchase. When you want to enjoy a safe, simple buying experience without all the headaches, a trustworthy dealer like BullionMax offers fair pricing on its wide selection of bullion products. Click here for specific questions on how BullionMax can help with your silver bullion purchase.